Real Estate Investment Trusts (REITs) are investment instruments that allow individuals to invest in income-generating real estate without directly owning or managing properties. By pooling resources from various investors, REITs enable the ownership and operation of large-scale commercial properties, including office buildings, shopping malls, warehouses, and data centers. This democratizes access to real estate investments, which were traditionally limited to large, institutional investors. REITs play a crucial role in the real estate and infrastructure sectors by providing a steady income stream to investors and contributing significantly to economic growth and development.

What is a Real Estate Investment Trust (REIT)?

Definition and Overview

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate across a range of property sectors. Modeled after mutual funds, REITs provide investors with an opportunity to earn a share of the income produced through commercial real estate ownership without actually having to buy, manage, or finance any properties themselves. This structure allows REITs to pool capital from numerous investors, thereby enabling participation in large-scale real estate projects that would otherwise be inaccessible to individual investors.

REITs encompass various property sectors, including office buildings, shopping malls, warehouses, data centers, apartments, and hotels. By investing in REITs, individuals gain exposure to real estate assets and enjoy benefits such as diversification, professional management, and the potential for regular income through dividends. This democratization of real estate investment has made REITs an attractive option for both retail and institutional investors seeking stable income and portfolio diversification. The performance and attractiveness of REITs are often influenced by economic factors, property market conditions, and regulatory frameworks, making them a dynamic and essential component of the financial market.

Legislative Framework (India and Global)

In India, REITs are governed by the Securities and Exchange Board of India (SEBI), with guidelines first introduced in 2007 and updated in 2014. These regulations were designed to create a transparent and robust framework that facilitates the growth and stability of the REIT market. SEBI mandates that REITs must be listed on stock exchanges, maintain a minimum asset base, and ensure regular disclosure of financial information to protect investor interests. The introduction of MSM REITs in 2023 further expanded the market by lowering entry barriers for smaller investors, fostering greater participation in real estate investments.

Globally, REITs operate under various regulatory frameworks tailored to each country’s financial and legal environment. In the United States, REITs are regulated by the Securities and Exchange Commission (SEC) and must comply with specific requirements outlined in the Internal Revenue Code. These include distributing at least 90% of taxable income as dividends to shareholders and investing a minimum percentage of assets in real estate. Other countries, such as the United Kingdom, Japan, and Australia, have their own regulatory bodies and guidelines governing REIT operations, ensuring that these investment vehicles adhere to national standards for transparency, investor protection, and financial reporting.

Also explore more about Fractional Ownership of Real Estate

Key Characteristics of REITs

REITs have several defining characteristics that make them unique and attractive investment vehicles:

- Income Generation through Real Estate: REITs generate income primarily through the leasing and renting of properties. This rental income is then distributed to shareholders in the form of dividends, providing a steady and often substantial income stream. The regular distribution of income is one of the most appealing features of REITs for investors seeking stable returns.

- Specific Sectors: REITs can focus on a diverse range of real estate sectors, allowing investors to choose based on their preferences and risk tolerance. These sectors include:

- Residential: Properties such as apartment complexes and residential housing.

- Commercial: Office buildings, retail spaces, and shopping malls.

- Industrial: Warehouses, logistics centers, and manufacturing facilities.

- Specialized Sectors: Emerging sectors like data centers, which provide essential infrastructure for the digital economy; warehousing, which supports the growth of e-commerce; and green finance projects, which focus on environmentally sustainable and energy-efficient buildings.

By diversifying across these various sectors, REITs offer investors the flexibility to tailor their investment portfolios to specific real estate markets and trends, thereby optimizing potential returns while mitigating risks.

How REITs Work

Structure of REITs

REITs are structured to ensure that a significant portion of their income is returned to investors, offering a unique combination of liquidity, income, and diversification. Typically, REITs are organized as trusts or corporations that purchase, manage, and operate real estate properties. Here are the key elements of their structure:

- Organization: REITs are usually structured as trusts or corporations. This organizational framework allows them to own, manage, and finance real estate properties effectively.

- Income Distribution: To maintain their status and benefit from favorable tax treatment, REITs are required to distribute at least 90% of their taxable income to shareholders in the form of dividends. This high distribution requirement is a primary characteristic that distinguishes REITs from other investment vehicles, ensuring a steady flow of income to investors.

- Investment and Management: REITs primarily invest in income-producing real estate, which includes properties like office buildings, shopping centers, apartments, warehouses, and specialized facilities such as data centers. They generate revenue through rental income and, in some cases, through the appreciation of property values. Professional managers handle the day-to-day operations, maintenance, leasing, and strategic planning to maximize the income and value of the properties.

- Diversification and Risk Management: REITs often hold a diversified portfolio of properties across different sectors and geographic locations. This diversification helps spread risk and can provide more stable returns. By investing in a REIT, individual investors gain access to a professionally managed portfolio of real estate assets, which would otherwise be difficult to achieve on their own.

- Compliance and Regulation: In addition to income distribution requirements, REITs must comply with specific regulations depending on the country they operate in. For example, in the United States, REITs must adhere to the guidelines set forth by the Securities and Exchange Commission (SEC) and the Internal Revenue Code. In India, REITs are regulated by the Securities and Exchange Board of India (SEBI), which sets forth guidelines to ensure transparency and protect investors.

By adhering to these structural requirements, REITs can provide investors with a reliable source of income, exposure to real estate markets, and the potential for long-term capital appreciation, all while mitigating some of the risks associated with direct property ownership.

Operational Mechanics and Income Distribution

REITs function by acquiring and managing income-generating properties. Here’s a detailed look at their operational mechanics and how they distribute income to shareholders:

- Revenue Generation:

- Rent Collection: The primary source of income for REITs is the rent collected from tenants occupying the properties they own. This can include residential units, office spaces, retail locations, industrial warehouses, data centers, and more. The lease agreements with tenants provide a steady stream of revenue.

- Property Sales: While rent is the main income source, REITs can also generate income by selling properties that have appreciated in value. This can be a strategic move to reinvest in more lucrative properties or sectors.

- Other Services: Some REITs also earn additional income from ancillary services such as property management fees, parking fees, and maintenance services.

- Operational Expenses:

- Maintenance and Management: A portion of the revenue collected from tenants is allocated to maintaining and managing the properties. This includes costs associated with repairs, landscaping, security, and overall property management.

- Administrative Costs: REITs also incur administrative expenses such as salaries for staff, marketing, legal fees, and other overhead costs necessary for running the business.

- Profit Distribution:

- Dividends to Shareholders: After covering operational expenses, REITs distribute the remaining profits to shareholders in the form of dividends. By law, REITs must distribute at least 90% of their taxable income to maintain their status, which provides a significant income stream for investors. This high payout ratio is one of the key attractions of REIT investments.

- Capital Gains: In addition to regular dividend payments, investors may also benefit from capital gains if the value of the properties owned by the REIT appreciates over time. When these properties are sold at a profit, the gains can be distributed to shareholders.

- Income Stability and Growth:

- Lease Agreements: Long-term lease agreements with tenants help ensure a stable and predictable income stream. Many REITs focus on acquiring high-quality tenants and securing long-term leases to minimize vacancy risks and ensure steady cash flow.

- Property Appreciation: Over time, well-managed properties tend to appreciate in value. REITs strategically manage their portfolios to enhance property values through renovations, upgrades, and efficient management practices.

- Compliance and Transparency:

- Regular Reporting: REITs are required to provide regular financial reports and disclosures to regulatory authorities and shareholders. This ensures transparency and allows investors to make informed decisions.

- Regulatory Compliance: Adhering to strict regulatory guidelines ensures that REITs operate in a manner that protects investors’ interests and maintains market stability.

By efficiently managing properties and maintaining a steady flow of rental income, REITs can provide reliable returns to their investors, making them a popular choice for those seeking exposure to the real estate market without the complexities of direct property ownership.

Examples of Prominent REITs

- India: Embassy Office Parks REIT, Mindspace Business Parks REIT

- Global: Prologis (specializes in logistics facilities), Digital Realty Trust (focuses on data centers)

Types of REITs

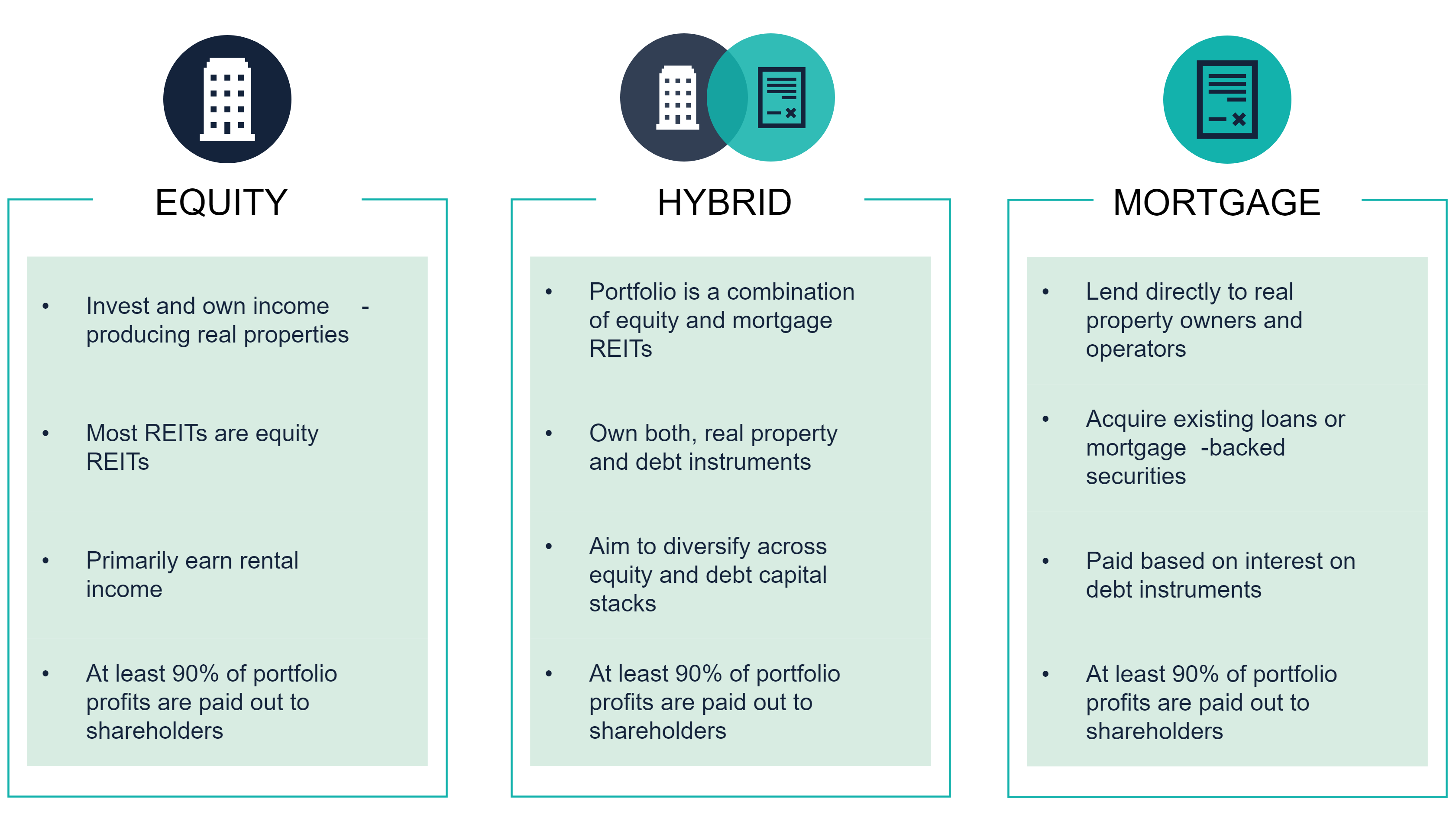

There are mainly three types of REITs:

Equity REITs

Equity REITs primarily invest in and own income-producing real estate. They generate revenue through leasing and renting out properties, focusing on various sectors such as residential, commercial, and industrial. The income from these properties is distributed to shareholders in the form of dividends.

Examples:

- India:

- Embassy Office Parks REIT: Embassy Office Parks REIT is the first publicly listed REIT in India, focused on office spaces and generating income through leasing to corporate clients.

- Global:

- Simon Property Group: Specializes in retail properties, owning and operating premier shopping, dining, entertainment, and mixed-use destinations.

- Prologis: A global leader in logistics real estate, owning and managing high-quality logistics facilities across strategic markets.

Mortgage REITs

Mortgage REITs (mREITs) provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities. They generate income primarily through the interest earned on these financial instruments. Mortgage REITs are more sensitive to interest rate changes and credit risks.

Examples:

- Global:

- Annaly Capital Management: One of the largest mortgage REITs, focusing on acquiring and managing a portfolio of mortgage-backed securities and other mortgage-related assets.

- AGNC Investment Corp.: Invests predominantly in residential mortgage-backed securities for which the principal and interest payments are guaranteed by a U.S. Government-sponsored entity.

Hybrid REITs

Hybrid REITs combine the investment strategies of both equity and mortgage REITs. They derive income from renting out properties as well as from the interest on mortgage loans. This diversified approach allows hybrid REITs to balance the income from property rentals with the earnings from mortgage investments.

Examples:

- Global:

- Starwood Property Trust: A leading diversified real estate finance company, focusing on both owning and financing real estate and infrastructure assets.

Emerging Types of REITs

Green Project REITs

Green Project REITs focus on environmentally sustainable real estate projects. These REITs invest in properties that meet specific green building standards and certifications, promoting energy efficiency, reduced carbon footprints, and overall sustainability.

Examples:

- India:

- GRIHA-certified projects under Embassy REIT: Embassy REIT has integrated sustainability into its portfolio with projects certified under the Green Rating for Integrated Habitat Assessment (GRIHA).

- Global:

- Hannon Armstrong Sustainable Infrastructure Capital: Focuses on investments in sustainable infrastructure projects, including energy efficiency and renewable energy.

Warehousing REITs

Warehousing REITs invest in industrial and logistics properties, capitalizing on the growing demand for warehousing and distribution centers driven by the e-commerce boom.

Examples:

- India:

- Indospace REIT: Specializes in the development and management of industrial and logistics parks across India, supporting the supply chain infrastructure.

- Global:

- Prologis: As mentioned earlier, Prologis is a global leader in logistics real estate, operating a vast network of warehouses and distribution centers.

- Goodman Group: A global integrated property group that owns, develops, and manages industrial real estate, including logistics and warehousing facilities.

Data Center REITs

Data Center REITs invest in properties that provide essential infrastructure for data storage, processing, and internet connectivity, catering to the growing demand for cloud computing and digital services.

Examples:

- India:

- Brookfield India Real Estate Trust (upcoming projects): Brookfield has announced plans to expand into the data center sector, leveraging its expertise in managing large-scale infrastructure projects.

- Global:

- Equinix: A leading global data center REIT, providing interconnected data centers and services to enterprises and network providers.

- Digital Realty Trust: Specializes in data center, colocation, and interconnection strategies, supporting the digital infrastructure needs of clients worldwide.

These diverse types of REITs offer investors a wide range of opportunities to participate in various sectors of the real estate market, each with its unique risk and return profile.

Also learn about NFTs and Architecture in Metaverse

Investing in REITs

Methods of Investment

Investors can engage with Real Estate Investment Trusts (REITs) through several avenues:

1. Publicly Traded REITs: Publicly traded REITs are listed on major stock exchanges, providing investors with the opportunity to buy and sell shares easily through brokerage accounts. These REITs are subject to market fluctuations and offer liquidity, allowing investors to participate in real estate markets without directly owning physical properties.

2. Non-Traded REITs: Non-traded REITs are not listed on public exchanges. They are typically offered through brokerage firms or financial advisors and often require a longer investment horizon compared to publicly traded REITs. Non-traded REITs may provide diversification benefits and access to real estate investments that are not correlated with public markets.

3. Private REITs: Private REITs are not publicly traded and are typically available only to institutional investors or accredited individuals. These REITs may offer opportunities to invest in specialized real estate sectors or specific geographic regions. Private REITs often have longer lock-up periods and may require larger minimum investments compared to publicly traded alternatives.

Benefits of Investing in REITs

1. Diversification: REITs provide investors with exposure to a diversified portfolio of real estate properties across various sectors such as residential, commercial, industrial, and specialized areas like data centers and healthcare facilities. This diversification can help reduce overall portfolio risk by spreading investments across different property types and geographic regions.

2. Liquidity: Publicly traded REITs offer high liquidity compared to direct real estate investments. Shares of publicly traded REITs can be bought and sold on major stock exchanges, providing investors with the flexibility to adjust their holdings based on market conditions or investment objectives.

3. Stable Income Stream: One of the primary attractions of REITs is their mandate to distribute at least 90% of their taxable income as dividends to shareholders. This distribution policy results in a consistent and potentially high yield income stream for investors. REIT dividends are often higher than those from other equity investments, making them particularly attractive for income-oriented investors.

4. Comparison with Direct Real Estate Investment: Investing in REITs offers the benefit of real estate exposure without the complexities and responsibilities associated with direct property ownership. Investors can participate in the income and potential appreciation of real estate assets without managing properties, dealing with tenants, or handling property maintenance and operations.

5. Professional Management: REITs are managed by experienced professionals who specialize in real estate investment and property management. These professionals handle day-to-day operations, property acquisitions, leasing, and maintenance, ensuring efficient management and optimization of real estate assets.

6. Potential for Capital Appreciation: In addition to stable dividend income, REITs may also offer potential capital appreciation as property values increase over time. This dual benefit of income generation and capital growth can enhance overall investment returns.

7. Regulatory Oversight and Transparency: REITs are subject to stringent regulatory oversight, providing investors with transparency regarding financial reporting, asset valuation, and governance practices. This regulatory framework enhances investor confidence and protects investor interests.

8. Tax Advantages: REITs often enjoy tax benefits, such as avoiding corporate income tax on earnings distributed as dividends. Shareholders may also benefit from preferential tax treatment on dividends, potentially lowering their overall tax liability.

Advantages and Disadvantages of REITs

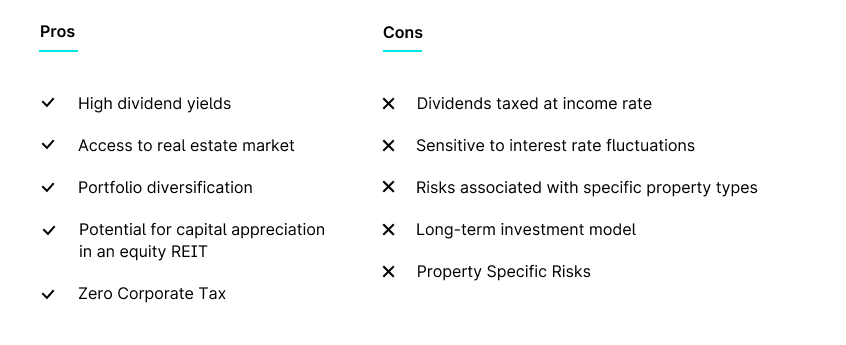

Pros of REITs

1. Diversification: REITs provide investors with exposure to a diversified portfolio of real estate properties across various sectors such as residential, commercial, industrial, and specialized areas like data centers and healthcare facilities. This diversification can help reduce overall portfolio risk by spreading investments across different property types and geographic regions.

2. Liquidity: Publicly traded REITs offer high liquidity compared to direct real estate investments. Shares of publicly traded REITs can be bought and sold on major stock exchanges, providing investors with the flexibility to adjust their holdings based on market conditions or investment objectives.

3. Stable Income Stream: One of the primary attractions of REITs is their mandate to distribute at least 90% of their taxable income as dividends to shareholders. This distribution policy results in a consistent and potentially high yield income stream for investors. REIT dividends are often higher than those from other equity investments, making them particularly attractive for income-oriented investors.

4. Comparison with Direct Real Estate Investment: Investing in REITs offers the benefit of real estate exposure without the complexities and responsibilities associated with direct property ownership. Investors can participate in the income and potential appreciation of real estate assets without managing properties, dealing with tenants, or handling property maintenance and operations.

5. Professional Management: REITs are managed by experienced professionals who specialize in real estate investment and property management. These professionals handle day-to-day operations, property acquisitions, leasing, and maintenance, ensuring efficient management and optimization of real estate assets.

6. Potential for Capital Appreciation: In addition to stable dividend income, REITs may also offer potential capital appreciation as property values increase over time. This dual benefit of income generation and capital growth can enhance overall investment returns.

7. Regulatory Oversight and Transparency: REITs are subject to stringent regulatory oversight, providing investors with transparency regarding financial reporting, asset valuation, and governance practices. This regulatory framework enhances investor confidence and protects investor interests.

8. Tax Advantages: REITs often enjoy tax benefits, such as avoiding corporate income tax on earnings distributed as dividends. Shareholders may also benefit from preferential tax treatment on dividends, potentially lowering their overall tax liability.

Cons of REITs

1. Market Risks: Like other publicly traded securities, REITs are subject to market volatility and fluctuations. Changes in economic conditions, interest rates, and real estate markets can impact the performance and valuation of REIT shares, potentially leading to capital losses for investors.

2. Limited Growth Potential: REITs are required by law to distribute a significant portion of their taxable income as dividends to shareholders. This distribution policy limits the amount of capital retained within the company for reinvestment in new properties or growth initiatives. As a result, REITs may have less flexibility to capitalize on growth opportunities compared to other investment vehicles.

3. Taxation of Dividends: Dividends received from REITs are typically taxed at ordinary income tax rates, which can be higher than the tax rates applied to qualified dividends from other types of investments. This tax treatment can reduce the after-tax returns for investors, especially those in higher tax brackets.

4. Interest Rate Sensitivity: Many REITs rely on debt financing to acquire and operate real estate properties. Consequently, they can be sensitive to changes in interest rates. Rising interest rates may increase borrowing costs for REITs, potentially impacting their profitability and dividend payouts.

5. Management Fees and Expenses: Investing in REITs often involves management fees and operating expenses, which can reduce overall returns for investors. These fees are typically deducted from the income generated by the properties before dividends are distributed to shareholders.

6. Sector-specific Risks: REITs focused on specific sectors such as retail, office, or healthcare properties may be susceptible to sector-specific risks. Factors such as changing consumer preferences, technological advancements, regulatory changes, or economic downturns can affect the occupancy rates, rental income, and overall performance of these REITs.

7. Lack of Control and Transparency: While REITs provide investors with exposure to real estate assets, shareholders have limited control over the management and operational decisions of the underlying properties. Investors rely on the expertise and decisions of REIT managers, which may impact investment outcomes.

8. Dependency on Real Estate Market Conditions: The performance of REITs is closely tied to the health and performance of the real estate market. Declines in property values, decreases in occupancy rates, or oversupply in specific markets can negatively impact the financial performance and dividend yields of REIT investments.

Regulatory Framework and Compliance

Requirements for Qualifying as a REIT

India: In India, Real Estate Investment Trusts (REITs) must comply with stringent regulations set forth by the Securities and Exchange Board of India (SEBI). Key requirements include:

- Income-Generating Real Estate: REITs must primarily invest in completed and revenue-generating real estate properties, such as office spaces, shopping malls, and warehouses.

- Distribution of Income: SEBI mandates that REITs distribute at least 90% of their taxable income to shareholders in the form of dividends. This distribution requirement ensures that REIT investors receive a substantial portion of the income generated by the underlying real estate assets.

Global: Regulations governing REITs vary across different jurisdictions, but there are common principles that most countries adhere to:

- Income Distribution: Globally, REITs are required to distribute a significant portion of their earnings to shareholders. This distribution typically ranges from 90% to 100% of taxable income and is a cornerstone of the REIT structure.

- Asset Management Rules: REITs are often required to adhere to strict asset management rules to maintain their tax-advantaged status. These rules include restrictions on the types of properties that can be held and the level of leverage that can be employed..

Regulatory Oversight and Investor Protection

India: In India, the regulatory oversight of REITs is overseen by the Securities and Exchange Board of India (SEBI). SEBI ensures that REITs comply with all regulatory requirements and operate transparently to protect the interests of investors. SEBI regulates the initial public offerings (IPOs) of REITs, their ongoing disclosures, and operational conduct to maintain market integrity.

Global: In other jurisdictions like the United States, the Securities and Exchange Commission (SEC) plays a similar role in overseeing REITs. The SEC monitors compliance with securities laws, ensures disclosure requirements are met, and investigates any potential violations to safeguard investor interests. Regulatory oversight ensures that REITs operate in a fair and transparent manner, providing investors with confidence in the integrity of these investment vehicles.

By adhering to these regulatory frameworks and oversight mechanisms, REITs uphold transparency, protect investor interests, and contribute to the stability of global real estate investment markets..

Recent Developments and Innovations

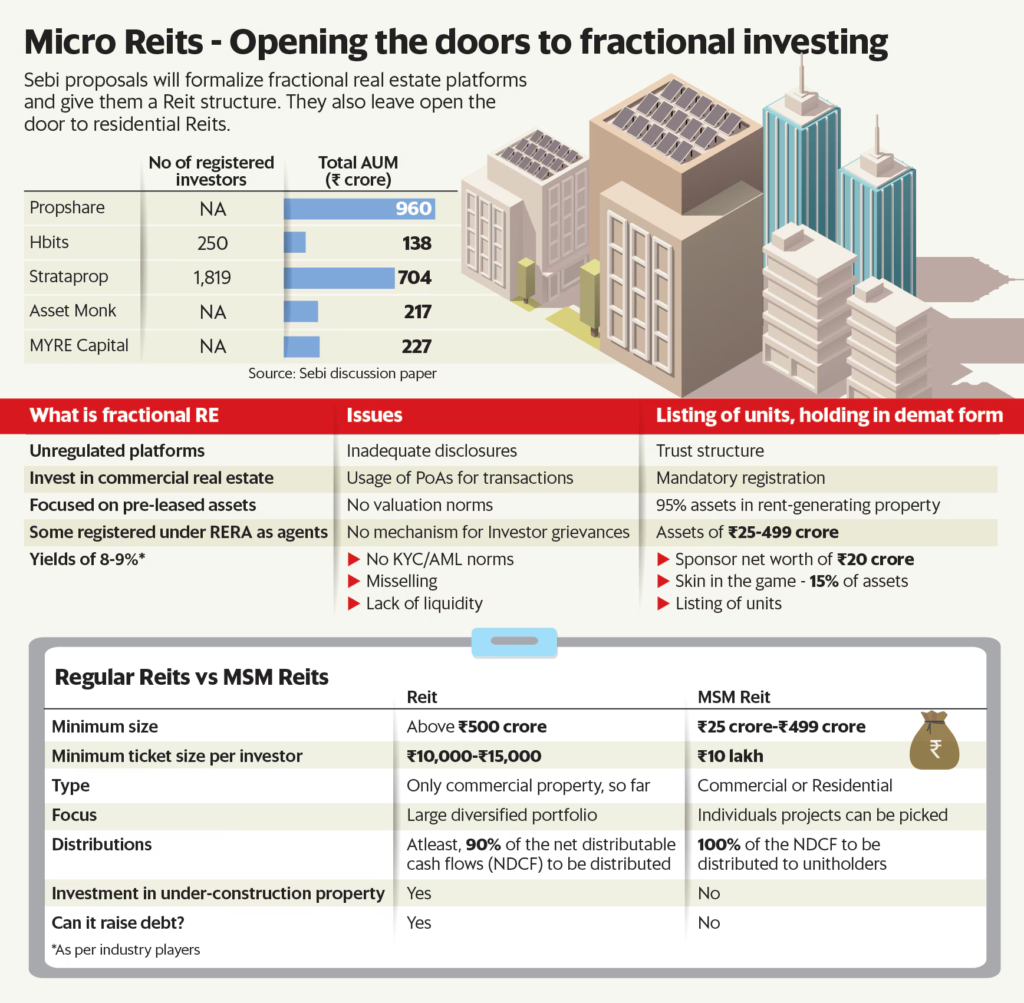

Introduction of MSM REITs in India

In a significant development for India’s real estate investment landscape, the Securities and Exchange Board of India (SEBI) introduced Micro, Small, and Medium Real Estate Investment Trusts (MSM REITs) in 2023. This initiative was designed to democratize access to real estate investments by lowering the capital threshold for participation. Unlike traditional REITs that typically require substantial capital commitments, MSM REITs allow investors to enter the market with significantly lower investment amounts, starting at INR 25 crores. This reduction in entry barriers aims to foster greater market liquidity and broaden the investor base, thereby stimulating growth in the real estate sector.

MSM REITs represent a tailored approach to accommodate smaller retail investors. It enables them to gain exposure to income-generating real estate assets across various sectors. By expanding accessibility and enhancing market participation, SEBI’s introduction of MSM REITs marks a pivotal step towards inclusivity in India’s financial markets. This innovation supports the development of a robust real estate investment ecosystem. It also aligns with broader economic goals of promoting investment diversity and capital mobilization.

Impact on Accessibility and Investment Landscape

The introduction of new types of Real Estate Investment Trusts (REITs), including those specializing in data centers, warehousing, and green finance, has significantly expanded investment opportunities within these burgeoning sectors. Traditionally dominated by institutional investors, these specialized REITs now offer avenues for a broader range of investors to participate in high-growth areas of the real estate market.

Data Centers: REITs focused on data centers cater to the increasing demand for digital infrastructure driven by the growth of cloud computing, big data, and digital transformation initiatives. These REITs invest in facilities that house servers and networking equipment critical for data storage and processing. And it helps in offering investors exposure to a sector poised for continued expansion.

Warehousing: With the rise of e-commerce and logistics, warehousing REITs have emerged as key players in the real estate landscape. These REITs invest in distribution centers and logistics facilities essential for the storage and distribution of goods. The growing demand for efficient supply chains and last-mile delivery services further underscores the importance of warehousing REITs in the modern economy.

Green Finance: REITs focused on green finance projects aim to promote sustainable development through investments in environmentally friendly real estate assets. These may include properties certified for energy efficiency, renewable energy projects, and sustainable building initiatives. Green finance REITs not only generate financial returns but also contribute to environmental stewardship and meet the rising demand for sustainable investment opportunities.

By diversifying the types of REITs available, regulators and market participants are facilitating greater capital allocation into critical sectors while providing investors with options aligned with their financial goals and ethical considerations. This expansion enhances the resilience and inclusivity of the real estate investment market, positioning REITs as versatile instruments capable of driving both economic growth and sustainability objectives.

Case Studies of REITs

Overview and Performance of Select REITs

India:

- Phoenix Mills

- Overview: Phoenix Mills is a prominent player in the Indian real estate market, focusing on retail properties.

- Performance: The company operates successful malls across major Indian cities, including Mumbai, Pune, Bangalore, and Chennai. These malls not only attract large foot traffic but also generate substantial revenue through a mix of retail, entertainment, and dining options.

- Brigade REAP

- Overview: Brigade Real Estate Accelerator Program (REAP) is a pioneering initiative in India’s real estate sector.

- Impact: This program supports startups and innovators in the real estate industry by providing them with mentorship, funding, and strategic guidance. Brigade REAP aims to foster innovation and entrepreneurship within the sector, contributing to its overall growth and sustainability.

Global:

- Vornado Realty Trust

- Overview: Vornado Realty Trust is a leading real estate investment trust focused on office and retail properties in major U.S. markets.

- Portfolio: The trust owns and manages a diverse portfolio of high-profile properties. It includes office buildings in New York City’s Manhattan and prime retail spaces in urban centers like Times Square. Its strategic investments and developments have consistently delivered strong returns for investors.

- Unibail-Rodamco-Westfield

- Overview: Unibail-Rodamco-Westfield is a premier global developer and operator of flagship shopping destinations.

- Presence: With a significant presence in Europe and the United States, the company manages iconic shopping centers known for their retail diversity, entertainment offerings, and visitor experiences. These destinations are hubs for retail, dining, and leisure activities, attracting millions of visitors annually.

- Alexandria Real Estate Equities

- Overview: Alexandria Real Estate Equities focuses on life science and technology campuses located in key innovation clusters.

- Innovation Impact: The company provides state-of-the-art facilities and services to leading biotechnology and technology companies. By supporting cutting-edge research and development, Alexandria Real Estate Equities plays a crucial role in advancing scientific discoveries and technological innovations globally.

- Goodman Group

- Overview: Goodman Group is a global leader in industrial property management, specializing in logistics and warehousing solutions.

- Sector Leadership: The group’s extensive portfolio includes modern logistics facilities strategically located across key logistics hubs worldwide. These properties support the operations of multinational companies involved in e-commerce, retail distribution, and supply chain management.

Tips for Investing in REITs

Factors to Consider Before Investing

Investing in Real Estate Investment Trusts (REITs) can be a lucrative opportunity for income generation and portfolio diversification. Before investing, consider the following factors to make informed decisions:

- Property Portfolio

- Diversity and Quality: Evaluate the REIT’s portfolio of properties. Look for diversity across different property types (e.g., office, retail, industrial) and geographic regions. A well-diversified portfolio can mitigate risks associated with fluctuations in specific sectors or markets.

- Location and Market Position: Assess the locations of the properties and their market competitiveness. Properties located in high-demand areas with stable rental markets generally provide more reliable income streams.

- Management Team

- Experience and Track Record: Examine the qualifications and experience of the REIT’s management team. A seasoned management team with a proven track record in real estate acquisition, management, and operations is crucial for effective portfolio management and value creation.

- Strategic Vision: Understand the management’s strategic vision for property acquisition, leasing, and capital deployment. Transparent communication and alignment of interests between management and investors are essential for long-term success.

- Financial Health

- Funds from Operations (FFO): Review the REIT’s financial statements, particularly focusing on Funds from Operations (FFO). FFO is a key metric that indicates the REIT’s ability to generate cash flow from its core operations. Analyze trends in FFO growth over time to assess financial stability and operational efficiency.

- Balance Sheet Strength: Evaluate the REIT’s balance sheet for indicators of financial health, such as debt levels, liquidity ratios, and interest coverage ratios. A strong balance sheet with manageable debt and adequate liquidity positions the REIT to withstand economic downturns and capitalize on growth opportunities.

- Dividend Yield and Sustainability

- Consistency of Dividend Payments: Assess the REIT’s historical dividend payments and dividend yield. Consistent and sustainable dividends are attractive to income-seeking investors. Analyze the REIT’s payout ratio (dividends paid divided by FFO) to gauge the sustainability of dividend distributions.

- Dividend Reinvestment Plans (DRIPs): Consider whether the REIT offers a Dividend Reinvestment Plan (DRIP), which allows investors to reinvest dividends into additional shares at discounted prices. DRIPs can enhance long-term returns through compounded growth.

- Market and Economic Conditions

- Interest Rate Sensitivity: Understand the REIT’s sensitivity to interest rate changes. Higher interest rates can increase borrowing costs for REITs and affect their profitability. Evaluate how the REIT manages interest rate risk through hedging strategies or variable rate debt.

- Macro-Economic Trends: Consider broader economic trends and their potential impact on the real estate market. Factors such as economic growth, employment rates, and consumer spending can influence property demand and rental income.

By thoroughly evaluating these factors, investors can make well-informed decisions when selecting REITs for their investment portfolios. Diversification across different types of REITs and ongoing monitoring of market conditions are essential practices for optimizing returns and managing risks in real estate investments.

Strategies for Maximizing Returns and Minimizing Risks

Investing in REITs can offer attractive returns and diversification benefits to portfolios. Implementing the following strategies can help investors optimize their REIT investments:

- Diversification Across Sectors and Geographies

- Sector Diversification: Spread investments across various sectors within the real estate market, such as office, retail, industrial, residential, and specialized sectors like healthcare or data centers. Sector diversification can reduce portfolio volatility and mitigate sector-specific risks.

- Geographic Diversification: Invest in REITs that hold properties in different geographic regions or markets. Geographic diversification helps to offset regional economic fluctuations and regulatory risks, ensuring more stable income streams.

- Long-Term Perspective

- Focus on Fundamentals: Adopt a long-term investment horizon when investing in REITs. Focus on the fundamental strengths of the REIT, such as quality of properties, management expertise, and financial health, rather than short-term market fluctuations.

- Income and Growth Potential: Consider the REIT’s potential for both income generation through dividends and capital appreciation over time. Evaluate the sustainability of dividends and the REIT’s ability to reinvest in properties for future growth.

- Regular Monitoring and Adjustment

- Market Trends and Performance: Stay informed about market trends, economic indicators, and regulatory changes that could impact the real estate sector and REIT performance. Regularly review the performance of your REIT investments against benchmarks and adjust your portfolio as needed.

- Rebalancing and Risk Management: Periodically rebalance your portfolio to maintain desired asset allocation and risk exposure. Assess the risk-return profile of each REIT investment and consider reallocating assets based on changing market conditions and investment goals.

- Risk Management Strategies

- Interest Rate Sensitivity: Understand the REIT’s sensitivity to interest rate changes and consider strategies to mitigate interest rate risk, such as investing in REITs with diversified financing structures or hedging against interest rate fluctuations.

- Liquidity Risk: Evaluate the liquidity of the REIT’s assets and the liquidity profile of the REIT itself. Choose REITs with sufficient liquidity to meet redemption demands and navigate volatile market conditions.

- Credit and Tenant Risk: Assess the credit quality of tenants and the REIT’s tenant diversification. Choose REITs with high-quality tenant leases and a track record of maintaining stable occupancy rates and rental income.

- Tax Considerations and Efficiency

- Tax-Efficient Investing: Understand the tax implications of investing in REITs, including dividends taxed at ordinary income rates. Consider holding REITs in tax-advantaged accounts, such as IRAs or 401(k)s, to minimize tax liabilities and maximize after-tax returns.

- Utilize Tax-Deferred Accounts: Take advantage of tax-deferred growth opportunities offered by REITs, such as 1031 exchanges or Opportunity Zone investments, to optimize tax efficiency and enhance long-term investment returns.

By implementing these strategies, investors can effectively manage risks associated with REIT investments while positioning themselves to capitalize on the income and growth potential of the real estate market. Regular monitoring and strategic decision-making are essential to achieving long-term financial goals through REIT investments

REITs offer a compelling way to invest in real estate without the hassles of direct property ownership. They provide diversification, liquidity, and a stable income stream, making them an attractive option for both individual and institutional investors. As the real estate landscape evolves, new types of REITs focusing on sectors like data centers, warehousing, and green finance are emerging, offering additional opportunities for growth and investment. By understanding the different types of REITs and their unique benefits, investors can make informed decisions and potentially enhance their investment portfolios.

Also explore more about Definitions : Real Estate and Construction Terminologies