The real estate landscape in India is evolving rapidly with innovative concepts reshaping property ownership. From the advent of serviced apartments to the disruptive tenancy models introduced by platforms like Airbnb, the sector is witnessing transformative changes. Among these advancements, fractional real estate ownership emerges as a promising trend poised to define the future of property investment in India. This model allows investors to own fractions of high-value properties, offering new avenues for financial participation and flexibility. As this trend gains momentum, it promises to democratize access to real estate assets and reshape investment opportunities across the country.

What is Fractional Ownership?

Fractional ownership is a co-ownership model where multiple investors collectively own high-value assets such as planes, yachts, or real estate properties. This arrangement allows individuals to pool their resources, share costs, and spread risks, democratizing access to luxury items that would typically require substantial financial investment if purchased outright.

The appeal of fractional ownership lies in its ability to provide access to premium assets without the full financial burden of sole ownership. Investors can enjoy the benefits of owning these assets, including potential returns from appreciation and rental income, while sharing expenses such as maintenance, insurance, and operational costs with other co-owners. This model offers flexibility in how the asset is used, allowing owners to schedule usage rights according to their needs or lease out the asset for additional income.

Overall, fractional ownership represents a versatile investment opportunity that appeals to individuals seeking to diversify their portfolios with high-value assets, all while minimizing financial risk and maximizing potential returns.

Key Features of Fractional Ownership

- Joint Ownership and Cost Sharing: Investors collectively own assets based on their financial contributions, allowing access to properties otherwise unaffordable individually. They share initial purchase costs and ongoing maintenance expenses, facilitating diversification across multiple assets for improved risk management.

- Risk Mitigation and Management: Risks such as market fluctuations and maintenance issues are spread among owners, reducing individual exposure. Professional management ensures assets are well-maintained and income-generating through rentals if applicable, enhancing overall security and operational efficiency.

- Usage Rights and Flexibility: Ownership agreements define guaranteed access for personal use or rental income, ensuring equitable distribution among owners. Investors can adjust their investment levels over time and potentially sell their share, providing liquidity and flexibility not typically found in traditional real estate investments.

- Appreciation Potential and Legal Structure: Properties held through fractional ownership can appreciate over time, offering potential returns upon sale, especially when managed professionally. Structured under entities like Specific Purpose Vehicles (SPVs) or LLCs, fractional ownership provides legal protection and clear ownership rights for participants.

- Lifestyle Benefits and Sustainability: Fractional ownership allows owners to enjoy luxury assets without bearing the full costs and responsibilities of sole ownership, thereby enhancing lifestyle options. Sharing assets also promotes sustainability by reducing environmental impact and appealing to environmentally conscious investors.

- Community and Technological Integration: Owners often form communities with shared interests, fostering networking opportunities and potential business relationships. Platforms leverage technology, such as blockchain for transparent ownership records and efficient management, enhancing operational transparency and security.

Types of Fractional Ownership

- Joint Ownership Model: In this model, all fractional owners collectively hold legal title to the property. Each owner has ownership rights and typically shares in the usage rights based on their ownership percentage. Decisions regarding the property are made collectively among the owners, often requiring consensus or a majority vote for major decisions.

- Co-operative Model: In a cooperative ownership model, fractional owners join together to form a cooperative society or association. The cooperative entity purchases the real estate property on behalf of its members. Each member owns a share in the cooperative, which entitles them to occupancy rights or usage of the property. The cooperative manages the property and makes decisions through its governance structure, which may include elected officials or a board of directors.

- Company Model: Fractional owners can opt to form a company, such as a limited liability company (LLC) or a corporation, to acquire and hold real estate. Each owner holds shares in the company, which represents their ownership stake in the property. The company manages the property and makes decisions through its management team or board of directors. Ownership interests in the company can be bought or sold, providing flexibility in transferring ownership.

- Trust Structure: In a trust-based fractional ownership structure, a trust is created to hold legal title to the property on behalf of the fractional owners. The trust is managed by a trustee who oversees the property and manages it according to the trust agreement. Beneficial interests in the property are held by the fractional owners, who receive rights to use or occupy the property as specified in the trust agreement. Trust structures can provide clarity in ownership and succession planning.

Each of these fractional ownership models offers unique benefits and considerations, depending on the goals and preferences of the fractional owners involved. These models provide flexibility in managing shared ownership of real estate while ensuring legal protection and clarity in ownership rights.

Also explore on REITs: Investing in Real Estate Investment Trust

Mechanisms and Benefits of Fractional Ownership

Fractional ownership transforms the landscape of investment opportunities by allowing multiple individuals to collectively own high-value assets such as real estate, planes, or yachts. This innovative model breaks down financial barriers, enabling investors to share ownership costs, mitigate risks, and generate income through rental yields and asset appreciation. Managed through structured legal entities and professional oversight, fractional ownership offers a flexible and diversified approach to accessing and profiting from premium assets in today’s dynamic market environment.

Usage Rights Models

Pay-to-Use:

- Owners pay a fee to use the asset, typically calculated on a daily or weekly basis.

- Expenses related to maintenance, management, and any rental income generated are shared among the owners.

- Surplus income, after deducting expenses, is distributed among the owners based on their ownership percentage.

- This model provides flexibility for owners who may not use the asset regularly but wish to generate income when not in personal use.

Proportionate Assignment:

- Each owner is assigned specific usage days or periods annually, proportionate to their investment stake in the asset.

- The allocation of usage rights is determined based on the percentage of ownership held by each investor.

- Owners can use the asset during their designated periods as per the agreed-upon schedule.

- This model ensures equitable access to the asset among owners, balancing personal use and potential rental income opportunities.

Management and Operational Structure

Fractional ownership arrangements typically involve a structured management and operational framework to ensure the asset’s effective utilization and maintenance:

- Management Body: A professional management entity oversees day-to-day operations, including maintenance, scheduling of usage rights, and financial management. They ensure compliance with ownership agreements and handle tenant management if the asset is rented out.

- Maintenance and Upkeep: Regular maintenance tasks, repairs, and upkeep are managed by the appointed entity to maintain the asset’s value and functionality.

- Financial Administration: The management body handles financial transactions, including collection of usage fees, distribution of rental income, payment of expenses, and financial reporting to owners.

Legal and Governance Framework

- Legal Structure: Fractional ownership is structured through legal entities such as Specific Purpose Vehicles (SPVs), limited liability companies (LLCs), or trusts. These entities provide legal protection to owners and define rights and responsibilities.

- Governance Rules: Ownership agreements outline governance rules, including decision-making processes, dispute resolution mechanisms, and procedures for sale or transfer of ownership shares.

- Regulatory Compliance: Compliance with local regulations, tax obligations, and property laws is managed by the appointed management entity, ensuring adherence to legal requirements.

Benefits and Considerations

- Diversification: Allows investors to diversify their investment portfolio by owning a fraction of multiple high-value assets.

- Shared Costs: Reduces financial burden through shared costs of ownership, including acquisition, maintenance, and operational expenses.

- Access to Luxury: Provides access to luxury assets and amenities that may be financially inaccessible for individual ownership.

- Risk Mitigation: Spreads risks associated with ownership, such as market fluctuations and maintenance costs, across multiple investors.

- Flexibility: Offers flexibility in usage and investment size, accommodating varying preferences and financial capabilities of owners.

Emerging Trends and Innovations

- Technological Integration: Use of blockchain technology for transparent ownership records and smart contracts, enhancing security and efficiency.

- Sustainable Practices: Focus on sustainable development and eco-friendly management practices to appeal to environmentally conscious investors.

- Global Market Expansion: Increasing global interest and availability of fractional ownership platforms for diverse asset classes beyond real estate, including art, vehicles, and intellectual property.

Safety and Regulations for Fractional Ownership

- Risk Mitigation through Shared Ownership: Fractional ownership spreads the financial risk among multiple investors, reducing individual exposure to market fluctuations, maintenance costs, and other potential risks associated with property ownership. This shared risk approach enhances the safety of investments by diversifying risk across a group of stakeholders.

- Regulatory Landscape: Fractional real estate investments operate within varying regulatory frameworks depending on the jurisdiction. While some regions may have established regulations for real estate investments, others are still developing or lack specific guidelines for fractional ownership structures. Investors should be aware of local laws governing property ownership, investment disclosures, and tax implications to ensure compliance and protect their interests.

- Role of Technology: To address concerns about transparency and security, many international fractional ownership platforms leverage advanced technologies such as blockchain. Blockchain technology provides a decentralized and immutable ledger that records ownership details and transactions transparently. This enhances security by reducing the risk of fraud or manipulation of ownership records, thereby building trust among investors.

- Platform Reliability: Choosing reputable platforms that adhere to best practices in asset management and investor protection is essential. Established platforms often undergo rigorous licensing processes and adhere to regulatory requirements, providing additional layers of security and confidence for investors.

- Investor Due Diligence: Despite technological safeguards and risk-sharing mechanisms, investors should conduct thorough due diligence before participating in fractional real estate investments. This includes reviewing platform credentials, understanding legal agreements, assessing financial projections, and seeking professional advice when necessary.

- Emerging Regulations: As fractional ownership gains popularity globally, regulatory frameworks are evolving to address the specific challenges and opportunities of this investment model. Investors should stay informed about regulatory updates and industry developments to navigate potential changes effectively.

Examples: Global Fractional Real Estate Companies

Ember Co-Ownership:

Ember Co-Ownership specializes in offering shared ownership opportunities in luxury vacation homes globally. This platform enables individuals to invest in high-end properties located in desirable vacation destinations without bearing the full financial burden of sole ownership. Ember Co-Ownership provides a seamless and exclusive experience for its co-owners, ensuring access to luxurious accommodations and amenities. By pooling resources, investors can enjoy the benefits of vacation home ownership, including potential rental income and personal use, while minimizing costs and responsibilities associated with maintenance and management. Ember Co-Ownership aims to create a hassle-free experience for its investors, facilitating shared ownership in prestigious properties that might otherwise be inaccessible for individual buyers.

The Hideaways Club:

The Hideaways Club offers a sophisticated fractional ownership model where members invest in a diverse array of luxury properties worldwide. Founded in 2007, the club provides access to meticulously selected villas, chalets, and apartments in premier destinations across Europe, Asia, the Americas, and beyond. This membership-based model allows individuals to acquire shares in multiple properties, enjoying the perks of high-end real estate ownership without the full financial burden. The club manages and maintains these properties to impeccable standards, ensuring each residence is equipped with top-notch amenities for members’ exclusive use. This approach not only enhances the lifestyle benefits of ownership but also offers potential returns through property appreciation and rental income opportunities, making The Hideaways Club a sought-after choice for discerning investors seeking luxury and convenience in their travel experiences.

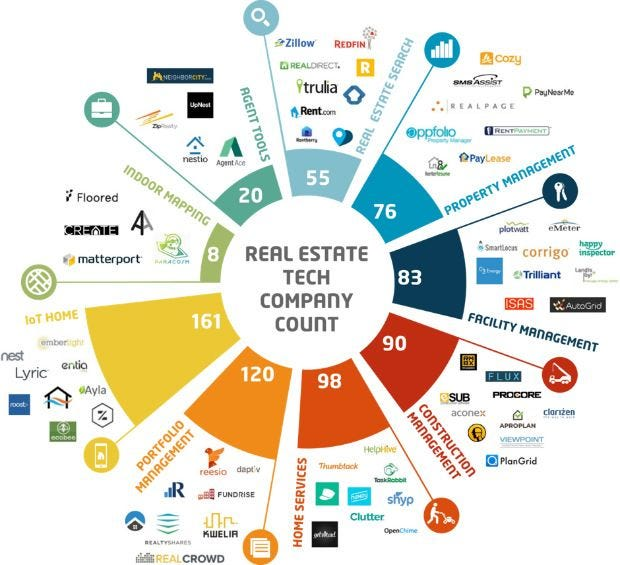

Property Technology Firms (Prop-Tech)

PropTech (Property Technology) firms are companies that utilize technology to innovate and improve various aspects of the real estate industry. These firms focus on enhancing efficiency, transparency, accessibility, and sustainability within real estate transactions, management, and investment processes. PropTech encompasses a wide range of technologies and applications, including but not limited to:

- Digital Platforms: PropTech firms often develop digital platforms that streamline property transactions, allowing users to buy, sell, rent, or invest in real estate online with ease. These platforms may integrate features such as virtual property tours, digital contracts, and secure payment systems.

- Data Analytics: Leveraging big data and analytics, PropTech firms provide insights into market trends, property valuations, and investment opportunities. This data-driven approach helps investors and stakeholders make informed decisions.

- Blockchain and Smart Contracts: Blockchain technology is increasingly used by PropTech firms to enhance transparency, security, and efficiency in real estate transactions. Smart contracts automate and enforce contract terms, reducing the need for intermediaries and minimizing transactional errors.

- Property Management Solutions: PropTech firms offer digital tools for property managers to streamline operations, maintenance, tenant communication, and financial management. These solutions improve efficiency, reduce costs, and enhance tenant satisfaction.

- Virtual Reality (VR) and Augmented Reality (AR): VR and AR technologies are utilized to create immersive property experiences, allowing potential buyers or tenants to visualize properties remotely and make more informed decisions.

- Sustainability and Energy Efficiency: Many PropTech firms focus on developing solutions that promote sustainable building practices, energy efficiency, and environmental stewardship within the real estate sector. This includes technologies for monitoring energy consumption, optimizing building performance, and achieving green building certifications.

- Crowdfunding and Fractional Ownership: Some PropTech firms specialize in crowdfunding platforms or fractional ownership models that enable investors to pool funds and collectively invest in real estate properties. These platforms democratize access to real estate investments, allowing smaller investors to participate in high-value properties.

Examples of PropTech Firms:

- Fraction: Fraction is a leading PropTech firm that specializes in facilitating pooled investments for shared ownership of diverse real estate assets. The platform targets investors seeking to participate in fractional ownership without high financial barriers typically associated with direct property ownership. Fraction’s user-friendly interface and technological integration streamline the investment process, offering transparency and accessibility across a variety of residential and commercial properties.

- hBits: hBits is a prominent PropTech firm in India focused on fractional ownership of commercial real estate. Specializing in high-quality commercial properties such as office spaces and retail centers, hBits allows investors to diversify their portfolios and earn passive income through rental yields. With a commitment to transparency and professional management, hBits aims to democratize access to commercial real estate investments, traditionally accessible only to institutional investors.

Know more about NFTs and Architecture for the Metaverse

Blockchain-Powered Tokenized Real Estate:

Blockchain technology enables the digitization of real estate assets into tokens that represent ownership. These tokens are securely recorded on a blockchain, creating transparent and immutable records of ownership. Tokenization divides real estate assets into smaller, tradable units, allowing investors to purchase fractions of properties, rather than entire units.

Key Features and Benefits:

- Security and Transparency: Blockchain ensures secure and transparent transactions by recording ownership on a decentralized ledger. This eliminates the need for intermediaries and reduces the risk of fraud or disputes.

- Fractional Ownership: Tokenization allows fractional ownership of real estate, enabling broader participation in high-value properties. Investors can purchase tokens representing a percentage of a property, diversifying their portfolios and reducing investment barriers.

- Liquidity: Tokenized real estate assets offer improved liquidity compared to traditional real estate investments. Investors can buy and sell tokens on secondary markets, providing flexibility and access to immediate liquidity.

- Automated Transactions: Smart contracts, powered by blockchain, automate transactions such as rental payments and property management fees. This reduces administrative costs and ensures timely disbursement of income to token holders.

- Global Accessibility: Blockchain technology facilitates global access to real estate investments. Investors from different countries can participate in tokenized offerings, expanding market reach and diversifying investor bases.

- Income Distribution: Rental income generated from tokenized properties can be distributed to investors in cryptocurrencies or stablecoins. This enhances efficiency in cash flow management and reduces currency conversion costs.

Examples of Blockchain-Powered Tokenized Real Estate:

- Propy: Propy is a global real estate marketplace that leverages blockchain technology to facilitate property transactions. It offers a platform where properties can be tokenized, enabling fractional ownership through blockchain tokens. Propy uses smart contracts to automate and secure the buying, selling, and renting of properties globally. The platform ensures transparency by recording all transactions on the blockchain, providing immutable records of ownership and transaction history. Investors can participate in tokenized real estate investments, benefiting from potential rental income and property appreciation, all managed through a decentralized and secure system.

- RealT: RealT is a blockchain-based platform that tokenizes real estate properties in the United States, particularly focusing on rental properties. Each property is tokenized into digital tokens representing fractional ownership. Investors can purchase these tokens, which entitle them to a portion of the rental income generated by the property. RealT uses blockchain technology to distribute rental income directly to token holders, ensuring transparency and efficiency in financial transactions. The platform provides investors with access to real estate investments that offer passive income streams and potential capital appreciation, all while leveraging the security and transparency of blockchain technology.

Blockchain-Based vs. Non-Blockchain-Based Platforms

Blockchain-Based Platforms:

Pros:

- Permanent and Secure Records of Ownership: Blockchain technology ensures that ownership records are immutable and transparent, reducing fraud and disputes.

- Seamless Rental Income Disbursement: Rental income can be disbursed in cryptocurrencies, offering faster transactions and potentially lower costs compared to traditional banking systems.

- Increased Transparency and Security: Transactions on blockchain are visible to all participants, enhancing trust and accountability in the platform.

Cons:

- Regulatory Challenges and Lack of Adoption: Blockchain platforms may face regulatory uncertainties and require adaptation to existing legal frameworks.

- Complexity: Understanding and implementing blockchain technology can be challenging for users unfamiliar with digital currencies and decentralized systems.

Non-Blockchain-Based Platforms:

Pros:

- Ease of Use: Traditional investors may find non-blockchain platforms more familiar and easier to navigate.

- Lower Entry Barriers: These platforms typically have simpler onboarding processes and may be more accessible to a broader range of investors.

- Regulatory Simplicity: They may face fewer regulatory hurdles compared to blockchain-based platforms.

Cons:

- Transparency and Security Concerns: Non-blockchain platforms may rely on centralized databases, raising concerns about data security and transparency.

- Dependency on Centralized Systems: Management and oversight are centralized, potentially increasing vulnerability to hacking or manipulation.

Choosing between blockchain-based and non-blockchain-based platforms often depends on factors such as investor familiarity with technology, regulatory environment, and desired level of transparency and security. Blockchain offers innovative solutions but requires careful consideration of its implementation challenges and legal implications.

Green Financing in Real Estate

Green financing in real estate represents a transformative approach that integrates sustainable practices into property development and management. This innovative strategy leverages financial mechanisms to support projects that prioritize environmental stewardship and energy efficiency. By incorporating renewable energy sources, energy-efficient technologies, and green building practices, green finance aims to not only reduce environmental impact but also deliver financial benefits to stakeholders.

These are the key aspects of Green Financing in Real Estate:

- Financial Incentives: Governments and financial institutions provide incentives such as tax breaks, subsidies, and favorable loan terms to promote investments in sustainable projects. These incentives lower the cost of capital and operational expenses, making green buildings more financially attractive.

- Technological Integration: Adoption of energy-efficient technologies and renewable energy sources reduces carbon footprints and operational costs over the long term. Innovations like smart building systems and green energy solutions enhance building performance and tenant satisfaction.

- Certification Standards: Standards like LEED and BREEAM certify buildings based on their environmental performance, energy efficiency, and sustainability features. These certifications ensure adherence to rigorous environmental criteria and provide transparency in sustainable building practices.

- Environmental Impact: Green financing supports the development of eco-friendly urban infrastructure, contributing to environmental conservation and resilience against climate change. It promotes responsible resource management and sustainable development practices across the real estate sector.

Also learn more about Green Building: Regulations and Certifications

Fractional ownership is gaining momentum in India, driven largely by the accessibility offered to tech-savvy millennials through platforms such as BRIKitt, Strata, and hBits. These platforms allow investors to acquire shares in premium properties with reduced entry barriers, marking a significant shift in how real estate investments are perceived and accessed.

As this trend continues to rise, it is poised to revitalize the Indian real estate sector by democratizing access to high-value assets. Small investors, who may have been previously excluded from the market due to financial constraints, can now participate in property ownership through fractional arrangements. This inclusivity not only expands the investor base but also injects liquidity and dynamism into the market.

The emergence of PropTech firms and the adoption of innovative financing methods like blockchain are pivotal in this transformation. These technologies enhance transparency, streamline transactions, and bolster security in real estate investments, fostering trust and confidence among investors.

Looking ahead, fractional ownership is expected to play a pivotal role in shaping a more inclusive and sustainable real estate market in India. By leveraging technology and innovative financial models, the sector stands poised to cater to diverse investor preferences while driving sustainable growth and development in urban infrastructure.