Welcome to our in-depth exploration of affordable housing policies in India, where we shed light on transformative initiatives such as the Pradhan Mantri Awas Yojana (PMAY) Urban and Gramin. As India grapples with the complex challenge of providing adequate housing for its citizens, PMAY Urban and Gramin emerge as pivotal strategies. PMAY Urban addresses the housing needs of urban areas, while PMAY Gramin focuses on rural regions, illustrating the government’s commitment to inclusive development. Through this article, we delve into the nuances of these policies, examining their impact, implementation, and the broader implications for India’s housing landscape. Join us as we navigate the intricacies of PMAY Urban and Gramin, charting their course in shaping the future of affordable housing in India.

Status of Affordable Housing in India

The definition of affordable housing in India

Affordable housing in India is defined both in terms of carpet area size and ticket price or commonly the cost of the house. According to the task force set up on Affordable housing MHUPA in 2008, affordable housing is defined by the size of dwelling units and affordability based on the household income of the population. Moreover, according to the RICS report on making urban housing work in India, affordability in the context of urban housing means the provision of ‘adequate shelter’ on a sustained basis, ensuring the security of tenure within the means of the common urban household.

Also read an Article exploring – Urban-rural inequality in India

|

Definition of affordable housing in India | |||

|

Income Categories |

Income Level |

Size of Unit |

Affordability |

|

Economically Weaker Section (EWS) |

<INR 1,50,000 per annum |

Up to 300 Sq.Ft |

EMI to monthly income – 30 to 40% |

|

Lower Income Group (LIG) |

INR 1,50,000 to 3,00,000 per annum |

Up to 300 Sq.Ft |

EMI to monthly income – 30 to 40% |

|

Middle Income Group (MIG) |

INR 3,00,000 to 1 million per annum |

600 to 1200 Sq.Ft |

House price to annual income – less than 5.1x |

|

Source: KPMG | |||

Also read an Article exploring – Modular and Manufactured homes of the future

The affordability of a house can be judged from the following parameters.

- Housing Cost

The ratio of housing expenditure to household income is used to measure affordability. This cost covers all costs related to rentals, utilities, and maintenance costs. Hence a house can be classified as affordable if the ratio satisfies the minimum cut-off value. The choice for the cut-off varies and is subject to various factors, however, a 30% can be considered as a thumb rule basis.

- Median Multiple Indicator

The median house price is divided by the median household annual income to derive housing affordability. A price-to-income ratio below 3 can be classified housing units as affordable, according to Dermographia International.

- Housing and Transport

This method includes transport costs along with housing costs to measure affordability. Congestion in cities has increased human settlements at long distances from city centres. This increases the costs and time spent commuting (Hamidi et all. 2016)

Various schemes available for affordable housing in India are as follow:

- Pradhan Mantri Awas Yojna – Urban

- Pradhan Mantri Awas Yojna – Rural

- National Urban Housing and Habitat Policy, 2007

- JnNURM (BHSP, IHSDP), basic services for the urban poor

- Integrated Housing and Slum Development Programme

- Interest Subsidy Scheme for housing the urban poor (ISHUP)

- Rajiv Awas Yojna

What are the challenges faced by affordable housing in India?

- Regulatory Constraints

- Development control on land

- Higher costs of construction

- Lack of access to home finance

Let us discuss on PMAY Urban and Gramin Scheme by Indian Government.

PMAY Urban

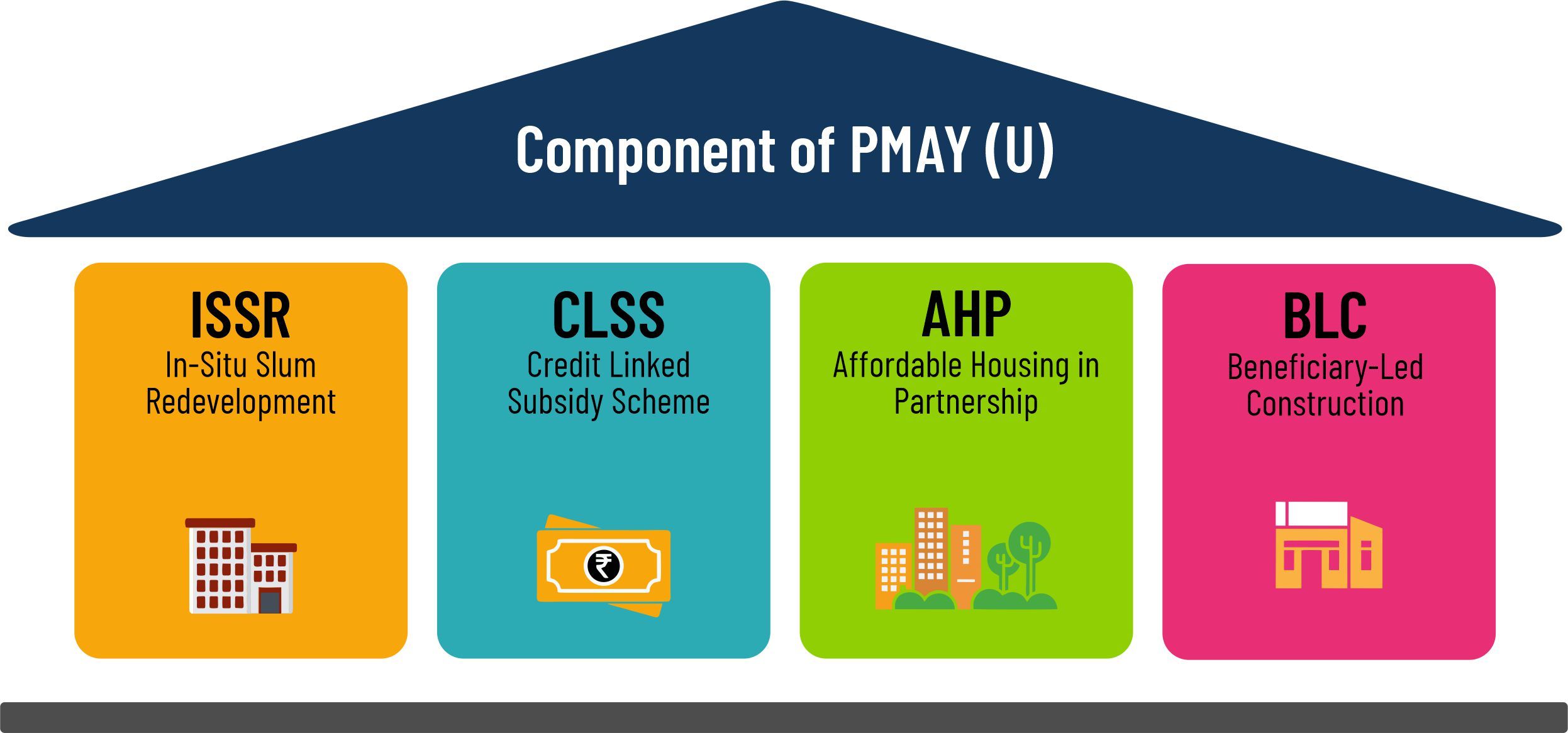

The Project is aimed at urban areas with the following components/options for States/Union Territories and cities:-

- Slum rehabilitation of Slum Dwellers with participation of private developers using land as a resource;

- Promotion of affordable housing for weaker sections through credit-linked subsidy;

- Affordable housing in partnership with Public & Private sectors and

- Subsidy for beneficiary-led individual house construction or enhancement

Feature of Pradhan Mantra Awas Yojana scheme:

- An interest subsidy of 6.5 per cent on housing loans will be provided for 15 years to the beneficiaries.

- Older and Differently abled persons will be given preference in the allotment of ground floors under the Pradhan Mantri Awas Yojana scheme.

- Eco-friendly and sustainable technologies will be used during the construction process.

i. ‘In-situ Slum Redevelopment (ISSR):

Central Assistance of Rs. 1 lakh per house is admissible for all houses built for eligible slum dwellers under the component of ISSR using land as a resource with the participation of private developers. After redevelopment, de-notification of slums by the State/UT Government is recommended under the guidelines.

Flexibility is given to States/Cities to deploy this Central Assistance for other slums being redeveloped. States/Cities provide additional FSI/FAR or TDR to make projects financially viable. For slums on private owned land, States/Cities provide additional FSI/FAR or TDR to land owners as per their policy. No Central Assistance is admissible in such a case.

ii. Credit Linked Subsidy Scheme (CLSS):

Beneficiaries of Economically Weaker Section (EWS)/Low Income Group (LIG), Middle Income Group (MIG)-I and Middle Income Group (MIG)-II seeking housing loans from Banks, Housing Finance Companies and other such institutions for acquiring, new construction or enhancement* of houses are eligible for an interest subsidy of 6.5%, 4% and 3% on loan amount up to Rs. 6 Lakh, Rs. 9 Lakh and Rs. 12 Lakh respectively. The Ministry has designated the Housing and Urban Development Corporation (HUDCO), National Housing Bank (NHB) and State Bank of India (SBI) as Central Nodal Agencies (CNAs) to channel this subsidy to the beneficiaries through lending institutions and for monitoring the progress. The scheme for the MIG category has been extended up to 31st March 2021.

iii. Affordable Housing in Partnership (AHP):

Under AHP, Central Assistance of Rs. 1.5 Lakh per EWS house is provided by the Government of India. An affordable housing project can be a mix of houses for different categories but it will be eligible for Central Assistance if at least 35% of the houses in the project are for the EWS category. The States/UTs decide on an upper ceiling on the sale price of EWS houses with an objective to make them affordable and accessible to the intended beneficiaries. States and cities also extend other concessions such as their State share, land at affordable cost, stamp duty exemption etc.

iv. Beneficiary-led Individual House Construction/ Enhancement:

Central Assistance up to Rs. 1.5 lakh per EWS house is provided to eligible families belonging to EWS categories for individual house construction/ enhancement. The Urban Local Bodies validate the information and building plan submitted by the beneficiary so that ownership of land and other details like economic status and eligibility can be ascertained. Central Assistance, along with State/UT/ ULB share, if any, is released to the bank accounts of beneficiaries through Direct Benefit Transfer (DBT) by States/UTs.

See also Affordable Housing at a Glance: Addressing the Homeless in India

PMAY Gramin

Key features of PMAY Gramin are as follows:

- Increase in minimum unit (house) size from 20 sq.mt. to 25 sq.mt. including a dedicated area for hygienic cooking.

- Increased monetary assistance of Rs.1.20 lakh in plains and Rs.1.30 lakh in hilly states, difficult areas and Integrated Action Plan districts in tribal and backward regions.

- Construction of quality houses by the beneficiaries using local materials and trained masons.

- The beneficiary also has a wide bouquet of structurally sound, aesthetically, culturally and environmentally appropriate house designs available to choose from rather than standard cement concrete house designs.

We are interested in hearing your comments on our article, PMAY Urban and Gramin – Affordable Housing in India. Connect with us through mail@greenarchworld.com